Mobile lending apps all reside on the Google Play Store, not because Android has more users but also due to the fact that Google’s policies have always made it easier for such applications to thrive but that seems to be changing.

Earlier on, Google announced plans to limit how apps access SMS of users phones, which would negatively impact mobile lending apps which require access to SMS for various reasons. As if that was not a big blow enough, Google has now made a change to its developer policies, particularly targetting short-term mobile lending platforms.

Henceforth, mobile lending apps which require users to repay loans in full within 60 days are no longer welcome on the Google Play Store.

“We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued (we refer to these as “short-term personal loans”). This policy applies to apps which offer loans directly, lead generators, and those who connect consumers with third-party lenders,” reads part of the policy.

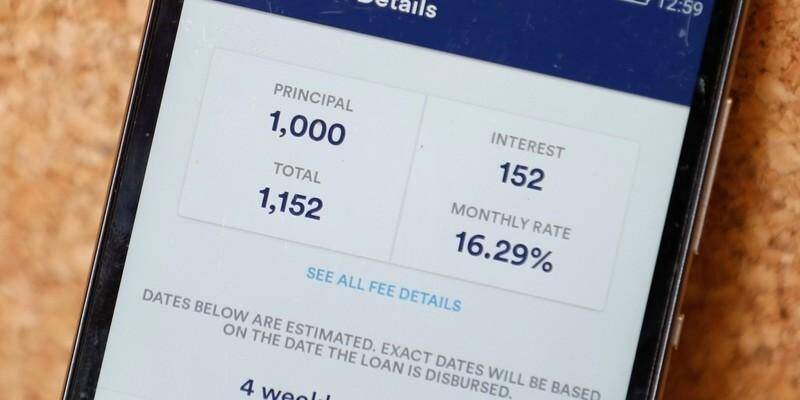

Furthermore, these loan apps will be required to disclose the following information to users before they download them:

- Minimum and maximum period for repayment

- Maximum Annual Percentage Rate (APR), which generally includes interest rate plus fees and other costs for a year, or similar other rate calculated consistently with local law

- A representative example of the total cost of the loan, including all applicable fees

As noted by Android Kenya, these changes will affect the number of mobile lending apps in Kenya. For instance, Tala’s longest repayment period is 30 days, similar to Barclays Bank’s Timiza platform. While other apps list their repayment periods and interest rates, Timiza does not, which puts it further in the red, against Google’s policies.

It is also not clear if other financial services apps that also offer short-term loans will be affected by these new policies, for instance, My Safaricom app offers access to M-Shwari and KCB M-Pesa, NIC Bank also has a short-term loan feature among other banking apps which now offer customers access to unsecured short-term loans.

Surprisingly, apps like O-Kash, OPesa and Branch, somewhat meet Google’s new requirements as per our check. So far, only Tala has spoken out on these changes, saying that Google is yet to issue any official communication to them, “We are yet to get any communication from Google. It is not clear if the new policy is applicable in U.S. market or globally,” said Kevin Kamburu Tala’s Regional Marketing and Brand Director.

If the apps do not comply with Google’s new policies, they could face a ban from the Play Store which would significantly reduce their reach, furthermore, there’s constant mounting pressure for the government to regulate these mobile lending platforms which have been accused of charging extremely high, interest rates, a characteristics that have seen them get labelled as “digital shylocks”.

Google’s new policies could end up favouring the borrowers more, especially if the government intervenes and puts a roof on the interest rates that these platforms can charge. As of now, we just wait and see how things play out.

[…] Cellular lending apps have been getting warmth from numerous involved events with residents calling for regulation over high-interest charges, governments being eager on cash laundering potentialities via the apps and even Google tightening its noose on what kind of lending apps it allows on Google Play Store. […]

[…] rates, governments being keen on money laundering possibilities through the apps and even Google tightening its noose on what kind of lending apps it allows on Google Play Store.Share […]