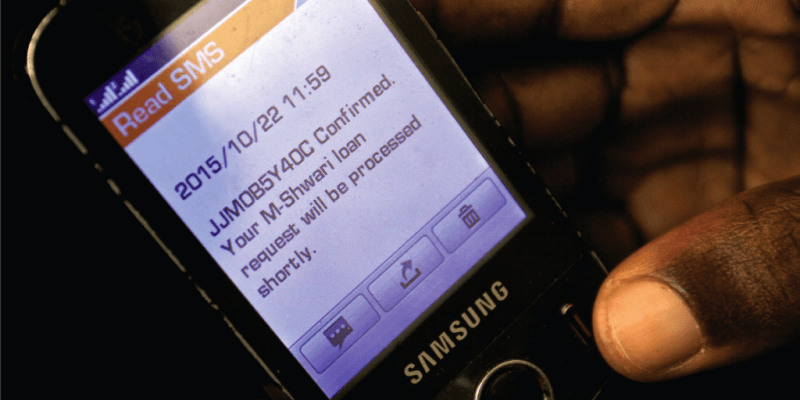

In recent developments regarding M-Shwari Loans, NCBA Group has differed with its partner Safaricom. Their feud comes in light of a statement from Safaricom to lower the M-Shwari rates.

How NCBA Runs Safaricom M-Shwari

NCBA runs the M-Shwari app in partnership with M-Pesa. It offers

- A maximum of Sh50,000 loan for up to 30 days

- Facilitation fee of 7.5% on credit regardless of its duration.

NCBA says This, Safaricom Says That

The bank said there were no immediate plans to cut the fees linked to M-Shwari. They are actually looking to focus on making the digital loan competitive relative to similar products in the market place.

The contradiction comes in as Safaricom stated that it was keen to reduce the cost as part of a larger plan that will see more features added on the M-Pesa platform.

“We would like the cost of this lending to come down and Safaricom is working to that end. It’s a regulated activity, certainly, we will push to find ways to make it cheaper,” Safaricom said earlier.

However, NCBA has a different point of view;

“We have never said that we are reducing the rate of M-Shwari. I do not think there have been any such plans.” NCBA group managing director John Gachora said to the Business Daily in an interview.

There is already underlying pressure from the State to curb unregulated digital mobile lenders who are charging exorbitant monthly interest rates and this does not lighten the situation.

We’ll have to wait and see whose word is law 😉

[…] Full Article at gadgets-africa.com […]

[…] Full Article at gadgets-africa.com […]