Facebook announced their new cryptocurrency that despite all speculation streaming earlier, was kept under lock and key and just as is the norm when it comes to the tech industry, a major part, if not all of it, was correct.

The digital currency called Libra has been revealed and touted as a move by the company in an effort to move the masses from the traditional bank system and in turn shake it up from its roots considering Facebook’s very own massive following of 2.4 billion users.

“Transform the Global Economy”

Facebook is touting the currency as a means to connect the billions of people around the globe who do not have access to customary banking services.

Starting with its very own die-hard users, who are still connected to the social network, it is expected that Libra will pose a huge threat to financial institutions across the world and would potentially help strengthen the agenda that the likes of Bitcoin have been trying to bring to the fold all this time.

Yes, Zuckerberg’s team is clearly very serious about venturing into this industry that may still be seen as young till now. This is considering the company has not just invested in the cryptocurrency but has also brought in 28 companies to finance its creation with a goal of signing up to 100 companies so as to secure the currency’s stability.

As aforementioned, every company was enlisted with a required contribution of $10million and an assurance of having a share of the profits brought in from the cryptocurrency.

The comradeship has included Visa, Paypal, MasterCard, Uber, Lyft, Vodafone, Spotify, eBay, Andreessen Horowitz and if I went on and on, you will probably stop reading this article. But the main point is that Facebook has thought ahead enough as they were blueprinting the creation of this prospective gem.

Speaking of thinking ahead, Libra is meant to be a global phenomenon; “empowers billions of people around the world” that is planned to launch in 2020.

With a great emphasis on taking the world by storm, the digital currency that Facebook insists on it being a non-profit association has had them partnering with 27 countries to create Libra.

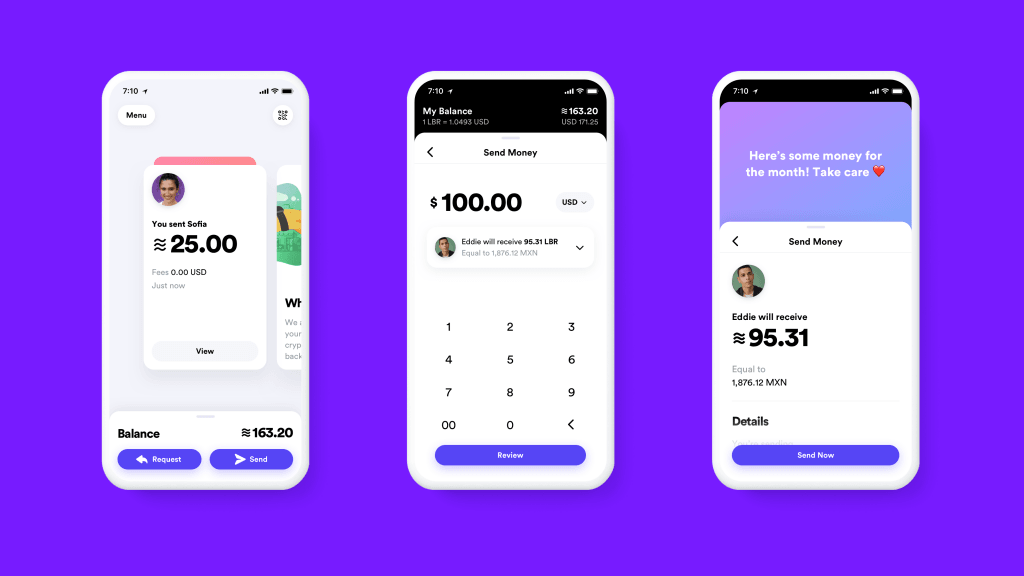

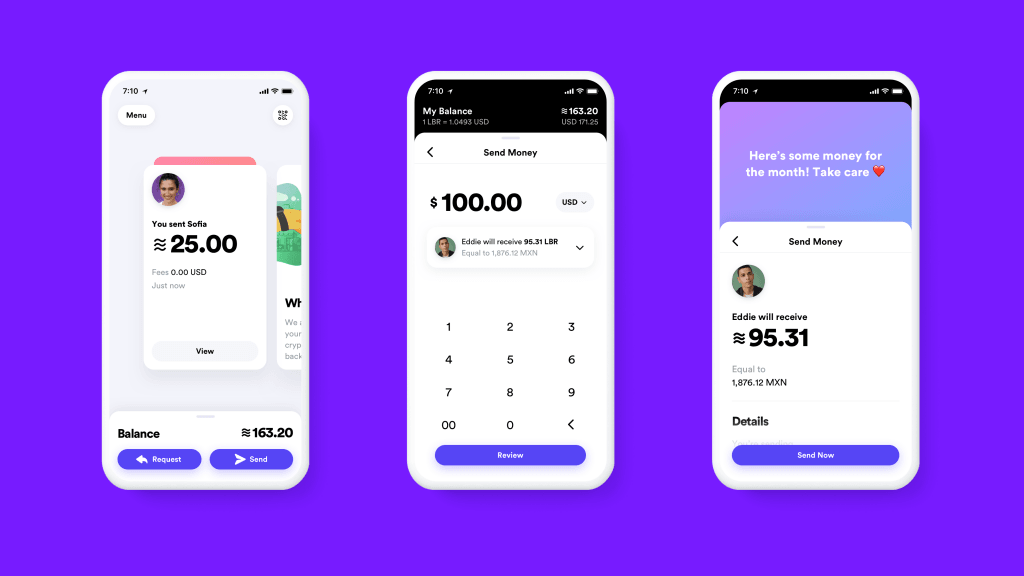

But this may also be seen in an effort to have Libra dig its roots into these countries’ economies and maybe win the hearts and minds of its citizens. But with the currency created alongside a digital wallet, Calibra, that will then be used in Facebook’s sister apps, WhatsApp and Messenger, it is reasonable to see why established coins like Bitcoin that is still rising in value and overall user figures should get worried about this unborn baby.

Libra vs M-PESA

But what about the likes of M-Pesa?

If we came back home and finally try and relate this to the most widely used money transfer network in Kenya, the question would be whether there should be concerns of significant contention from Libra.

Yes, M-Pesa is not particularly classified as a cryptocurrency but it does check out in almost every feature that a normal digital currency would claim to have as a qualification.

Even though Libra is globally seen as a huge threat to orthodox financial institutions, it would be safe to note that with the acclaim that Safaricom’s money transfer firm has been garnering in Africa and beyond, the currency would be pushed into the country all in a goal of being a “global financial infrastructure”.

“…People with less money pay more for financial services… hard-earned income is eroded by fees…”

If you read Libra’s white paper, the problem statement spotlights of how “people with less money pay more for financial services as well as how “hard-earned income is eroded by fees, from remittances and wire costs to overdraft and ATM charges.”

You would ignore it and place the statement as a jab to the banking system, but doesn’t M-Pesa also work the same?

Look at how much you pay for every single transaction even though, it is maybe, one of the most convenient systems we have had ever.

Plus, Libra itself will be transferrable through one of the most popular messaging apps that almost everyone with a smartphone uses, no matter how cheap.

Would this force the corporation (Safaricom) to be signed up as well as a member of the Libra association? After all, one of its major shareholders, Vodafone, is already a founding member and have enough influence to make them sign up.

But is Safaricom stubborn enough to have nothing shake them up in any way? Let’s say they did, will Libra now be an option of currency in the transfer network or will M-Pesa have to submit to the rules of low transaction charges?

But also considering how little Facebook is still trusted with our own data privacy, many will be completely turned off with the idea of trusting that very company with their “hard-earned” money.

Plus, with Kenyans’ normal reputation of resisting change, Libra will most likely have a terrible time to have to inform and convince people about its agenda and how stable it will be as a stand-alone money-network in the country.

It might then seem almost impossible to imagine a direct replacement of what we already we have now, but with the right dynamics, moves and obviously partnerships, the money transfer industry will definitely be one to watch out for.

After all, who doesn’t like seeing lively competition, apart from the competitors of course?

Comments